Today's paper trading plan review and thoughts

First of all, today's plan is much better than yesterday's.

What a day for bulls.

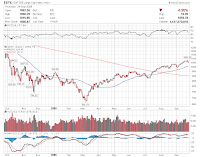

A market correction may be coming soon again

S&P 500 is still in a good shape for the bulls

Changed the blog time setting to the US Eastern Time Zone

As a result, my real time paper trading record may be more easily tracked.

The previous time setting is US Central Time Zone.

Long10000 UNG@11.85 this morning

Nightmare of the 401 (K) plan

Weekly Review

The S&P 500 has been UP for 5 days in a row ! What a nice week for the bulls !

UCTT - update: UP more than 20 percent today

It is also ranked number one in the NASDAQ market UP list today.

UNG - a nice chart with gap up

Previous island reversal gap up chart have been shown in the NASDAQ intra-day chart when NASDAQ is about 1800, which can be found in the blog here. since then the NASDAQ market has been keeping up !

The 1060 has been broken out with a gap

The 1060 has been broken out with a gap, which is exactly what i am feeling yesterday. Quoted here: "The intra-day reversal is pretty bullish." "One thing I am feeling is that another gap is in the shaping"

VISN - another china play chart set up

A range trading day

ETFC - the important ER date

I am pretty optimistic with ETFC's ER.

Previous updates on ETFC can be found here.

EPIC - a nice breakout chart

Previous important breakout charts are listed here.

S&P 500 is bounced off 1060 as predicted

Now it's hard to tell which one (bull or bear) is winning the battle. Tomorrow will be a key day to watch:

China play - CPBY

S&P 500 bounced off the 50MA

Very nice day !

Next major resistance level is 1060, if 1060 can be taken over by bulls, I will expect a new higher high than 1080.15 in the near future ! Bulls are not dead yet.

AVII - a possible bull

Reaction line, Reflective Wave, and Reaction Wave

A trend will be formed when reaction lines are continuously going up or going down.

The unemployment rate for September, 2009

The weak labor market could undermine economic recovery, to some degree, in my own opinion.

What a bloody day today

On September 23, 2009, I have posted the warning sign for bulls here. I sincerely hope you have unloaded some longs or loaded some shorts for hedging. Trading is like driving, when warning signs show, slow down your driving or adjust your positions and be prepared for possible dangers.

CIT - abnormal gaps up and down

Such gaps are hard if our positions are on the wrong side. Nevertheless, gaps are quite common in the stock markets, such as SQNM yesterday.

The key is to understand these gaps well and avoid them, if these gaps can not be taken advantage of.

- Avoid stocks that have a lot "hot" problems and on the news media

- Buying in only around the reaction line during the reaction wave, which will minimize the loss if the market against you and maximize the profits if the market is in favor your expectations.

Very very fortunately, today

S&P 500 - 1050

Please also notice that CIT has a big jump yesterday, and then a big drop today. Very very interesting. I will post the chart analysis of CIT later.

Important Previous Predictions Review

1. NASDAQ analysis on May 7, 2009

2. Is the Mad bull coming back ?

3. FAZ to $2 and sell QID at 35

4. Nasdaq target

5. My current view on US stock market and predictions on September 12, 2009

6. S&P 500 correction target ~1000

7. Market enters a correction

8. S&P 500 sees 1100 again pretty soon (realized)

the danger of the trading - SQNM

- Before the reaction line $4.44 is settled, anything could happen for both bulls and bears

- The small scale chart tells the story clearly

- Buying in only around the reaction line during the reaction wave. The potential loss will greatly reduced if the break down and break out take place with a huge gap

The market shows the power of the chart reading again today

Yesterday, in the general US stock market view post, I used the S&P 500 as an example and pointed out the following key point:

Today, when S&P 500 hits 1070 (actually 1069.62), it just comes back ! Isn't it beautiful ! Every time when the market proves my hypothesis, I am very pleased, not purely by the money made from the testing, but more by the better understanding of the market motions and evolutions.

So far, the market motion is pretty clear, and I want to point out the following key points to watch:

- 1050 - Bears need to break down this number in order to achieve a measurable bearish move

- 1070 - Bulls need to break out this level in order to sustain the bullish move

RINO - another crazy bull breakout

10 Bagger in half year, and breakout again quickly with a 100% gain in one Month.

A very classical chart to learn the rules how a stock is moving !

Other successful breakout chart patterns and the follow-ups can be found here !

ETFC - updates

The market is pretty bullish today

As mentioned last Wednesday, "It is still a bull market, the major trend has not changed. That's for sure. A trap-zone might be in the shaping now. That's the fact."

What a BUll - RODM - up 4200% in about 6 Months

The chart pattern is so standard ! A classical chart to learn how to trade with the chart !

Other successful breakout chart patterns and the follow-ups can be found here !

Reaction line

The reaction line is super important because via observing its elasticity you can know where the market will go next. Very reliable !

The reaction line can be classified as bullish reaction line and bearish reaction line.

The good long and short entry point is around the reaction line during the reaction wave to test the elasticity of the reaction line.

Once no elasticity or very few elasticity is shown for the reaction line during the tests of the reaction wave. A possible transition of the reaction may be coming soon, which serves as a warning sign to act and to protect your positions as soon as possible.

The beauty of the reaction line is that it can help us to ride with the big wave and avoid losses when the trend is reversed and against us. Very very neat. Once I have the opportunities, I will explain how to apply it in more details.

A new IPO - AONE up 50% in the first day

It is a battery maker.

Trade the stocks with a humble heart

However, that doesn't mean nobody can make money from the stock market. Instead, some people really made a fortune from the stock market. One key factor for us to be able to make money from the stock market, I think, is to be humble !

Then how to be humble ?

Here is my answer: when the market is against you, you need to be humble, and then follow the market, not fight with it.

How to turn this answer into practice ? Take selling as an example:

- You bought a stock ABCD at $10 and expect it go to $20 in one month. Unfortunately, it just climbs to $15 and coming back to $14, $13, and $12 ... what should you do then ? Still hold it and wait for your expected $20 to come in one day ? Absolutely not ! You need to be humble and protect your profits. Then you might wonder, what will happen if after my selling at $12, the stock jumps to $13. Take it easy, then. If you still think the stock ABCD can go back to $20 with a solid reason, then chase it ! No big deal ? right ?

- Holding positions always means you are exposed to some market risks. So stay alert ! Once the market development is against your expectation. Just sell all of them and protect yourself. Again, you can always buy back later when the market performs the way you expect.

As always, we

- buy in positions for expected profits; If the expected profits don't come as we expected, we need to exit the position to avoid the cash loss risk.

- sell out positions to avoid the expected loss; If the expected losses turned out to be a good profits opportunity, we need to be humble and buy back the position to avoid the missing opportunities.

However, to make these more practical, you need to build up a systematic approach and follow it closely by yourself.

SPX analysis and expectations

ETFC updates and my expectations

- If it can not stands well above 1.80, it will test the 1.69 support

- Once 1.69 is broken down, I expect ETFC will come to 1.50 level again

- If 1.50 can not hold it, then 1.25 is the next retreat target

- The key is 250MA should level out and finally level UP

- I really don't expect it will come back to below 1.15 level, if so, which is very unexpected, then the big trend reversal as initially called here in ETFC is gone.

Expectations

- You have your hypotheses

- You have your expectations, which is based on your hypotheses

- The market development will either performs as you expected or not performs as you expected

Following this way, your trading and investment skills will dramatically improve as time passes by.

Warning sign for the Bulls

However, it still need to closely monitor the market in order to understand how deep and how long of this market correction . So, no panic yet for bulls.

It is still a bull market, the major trend has not changed. That's for sure. A trap-zone might be in the shaping now. That's the fact.

S&P 500 5 days chart update and comments

ETFC - 5 day charts update

- Previous "V" pattern bottom line broken down

- Gap up with negative divergence, signals a measurable correction

- Previous analysis on ETFC and other stocks can be found here.

FFBC - what kind of bullish run

Other important breakout charts are listed here as well.

ETFC - the money-making zone is in the shaping

I will apply my stock price movement theory to chart the movement of ETFC from today. Previous analysis on ETFC and other stocks can be found here.

CLFD - continue to make new higher high

Previous comments on CLFD can be found here.

Random Market Thoughts

- In order to earn big, you need to be able to tolerate some market fluctuations. No bullish run is forming a line. So is the bearish move.

- The key is to identify the meaningful market corrections.

- These market corrections could lead to a trend reversal. You need to know when a market correction evolves into a trend reversal.

- Big trend changes slowly. If you want to earn big, you need to give your stocks and the market time to make your big profits.

- The key is to sit tight when you are correct. However, sitting tight doesn't mean doing nothing. You still need to closely watch the market development and understand its stages. You also need to know the signs for a meaningful market correction. More important, you need to know the signs for a market trend reversal.

- The rules could be simple. But it really requires a deep understanding the market, especially how the market motion is dynamically evolved.

ETFC chart updates

ETFC initially grabbed my attention when its chart said a potential trend reversal. The initial chart and post can be found here.

Since then, some followups and comments on ETFC can be found here.

The right thinking for the investment

Through more than 10 years' US and China stock market investment and speculation experience, I have learned a lot lessons. Actually, tons of them. However, the most important one so far for myself, I think, is the right thinking !

Thinking is a vital thing, not just for trading, but also for your whole life.

What you think will ultimately determine what you will do !

It's a big topic, and many bright minds are doing such researches and wish to decode the magics behind our brains.

One key thinking I want to share here is:

- The BIG market trend never ever easily and quickly changes, to the best of my knowledge, it really needs time to develop, to grow, and to die ! So hang on for the BIG picture with peace and joy in your heart !

For other important investment ideas, please follow the link here.

CLFD - up 500% so far

Some previous followups and comments on CLFD can be found here.

To be able to make big money in this "investment" game, there is only one way: sit tight when you are correct with the BIG trend ! Small waves only wash out weak hands !

The BIG trend or picture never changes easily ! So enjoy the riding process of the BIG wave ! At the same time, just watch how the waves are changing !

It's just so FUN and so BEAUTIFUL !

I miss you guys and the blog

Fortunately, We didn't miss the bullish run up for the past few days, which is more important !

The most important thing is to change your thinking now, if you are still acting as a bear like last year, namely 2008.

Two important forecasts and predictions in the past have been listed below:

If I think there is a need to modify or update my market views, I will post them in the blog as soon as possible.

Another nice thing about the blog, you can schedule your posts ! pretty neat ! I love it!

Enjoy the day !

GS - a leading indictor of the market

How amazing the bulls can hold DNDN for so long

BAC - a short review

For a thread on BAC's charts, the link is here.

LVS - the beautiful V in the chart

My current US stock market view and predictions

- If we can see quite measurable market corrections (such as S&P 500 drops to below 900) before August, 2010. Then This bull market from March, 2009 can continue for another year, at least. This will be a very good bull market. Very similar to those bull market 1995 --> 2000 and 2003 --> 2007, for example.

- If we can not see quite measurable market corrections (such as S&P 500 drops to below 900) before August, 2010. Then This bull market from March, 2009 will be over in the end of 2010 or early 2011.

Nevertheless, Please notice that the above conclusions are just based purely on my systematic statistical study on the US stock market behavior over the past 40 years. It may be wrong, even though the probability for being wrong is only 1%.

I will refer back to these important conclusions later as time is passing, no matter it is correct or wrong. Just to learn something from the market !

Put your bet with your analysis and your hypothesis, and let the market tell you if you are right or wrong ! It's a fun game, indeed, very fun game.

A chart to review - MGM

What are the bears' view on the current stock market

However, my mind is always OPEN to other opinions because this is related to real money. One mistake could kill us very easily in the market.

Here are some bears market view, I want to share here:

- Market will find a top in September

- Bears expect the stock market will crash again until the end of 2010.

Most bears reasoning are based on economic conditions analysis, very few of them are using the chart reading.

At the same time, bears are bullish on US dollars since dollar is strong during last market crash.

As expected before, ETFC's gap

This is a very good sign ! The previous post is linked here.

The series of the follow ups with regard to ETFC can be found here.

It would be very interesting to learn how long the gap can be held well

What a nice day for Bulls again

S&P 500 make a new higher high of 1044.14 today !

Only Dow Jones Industrial Average is left to beat the previous high of 9,666.71! I think It will make a new higher high soon !

Please change your mind, follow the trend, it's a bull's market !!

Every market correction will be a good buying in opportunity ! I will follow the market very closely here. Once I see some warning signs for the Bulls, I will inform you guys here !

Think about this, if NASDAQ stands well above 2000, S&P 500 stands well above 1000, these numbers are magic numbers, the market won't stop there for sure !

Fortunately, we have spotted this magic bullish run up since March ! I sincerely hope you do as well, at least, didn't short the market at the March's bottom !

Please recall my post on April 26 to learn, which is quoted here " It is a good time to learn how to know a rally is a Bull starts or still Bear reactions ..... "

Again, keep in mind that:

A big trend needs time to develop and will take time to change !

The big money only can be made through sitting tight when you are right !

I wish I still hold BAC which is bought at about 3 now.

Nasdaq made a new higher high today

What a day today !

Some people still think this is a bear market rally and think the rally or bullish run is irrational !

However, what I want to say is:

- Yes, there is a reason for market's up and down. But you probably don't know it now.

- When you know the reason, understand the reason, and think the market's move is very reasonable, so you jump in. Man, probably, you are too later

One thing is for sure: A big trend needs time to develop and will take time to change !

For example, the Bear market from 2007, ends until March 2009, it takes more than one year. So this Bull's market since March 2009, will probably end some time beyond 2010.

Some friends may ask what will happen after this pushing up wave ? I already posted before in only 15 points to my predicted target.

I quote it here again:

"Form a new no-trend zone, and destroy completely Bear's hope !"

the no-trend zone is the same as trap-zone.

So, you know a trap-zone is expected after the Bull's money-making zone is completed.

Another beautiful day for bulls

Every time, after the market correction, or the trap-zone in the language of my own theory, the market will be pushed up for a new higher high! That's typical since March this year. It is also typical for a bull market!

Let's see this time if a new higher high will be made. Put your bet, and crossing your figures!

Following the market trend is so wonderful !

ETFC - very good day

I am expecting today's gap up won't be filled for some time.

I have started following ETFC from the beginning of August, 2009, when ETFC is around 1.40. Here is the chart I posted in the blog.

The series of the follow ups with regard to ETFC can be found here.

What a bullish day today !

I know some friends are still bearish on the market because they don't know how to follow the trend ! I wish they have read my grand view on the market.

The rally from March is not a bear market rally, but, indeed, a new bull market !

Never fight with the trend, but follow it !

JAZZ - up 20-fold in 5 Months

Below is the review chart !

For other similar breakout charts, please follow the link.

VVTV - climbed more than 17-fold in half year

Below is the chart for review.

For other similar breakout charts, please follow the link.

SCSS - a 15-fold in about half year

For other similar breakout charts, please follow the link.

GIGM - review chart

- 50/250 golden cross three times forming a round bottom

- Then kiss three times before hit the all time high

- The 50/250 death cross marked the new DOWN trend.

Other technical analysis tips are linked here.

Some key points to watch a stock price development

In addition, don't just rely on some simple rules. Combinations of many tools are much more helpful and reliable.

Below is a short list of key points I always keep watching:

- 50MA and 250MA (the positions, movements, etc.)

- trap-zones vs. money-making zones

- chart patterns

- price relative positions

- previous substantial waves (UP or DOWN)

SPPI - a nice breakout and run chart

- Gap ups

- 50 and 250 MA

- V bottom line

- /\ top line

- trap -zone and money-making zones

ETFC - the bottom line

Previous posts on ETFC can be found here.

The unemployment rate rose to 9.7 percent in August

But the market is still in green. Pretty good !

Grand view of the current stock market: S&P500 as an example

Below is a daily chart for S&P500, which is perfect for today's grand view on the current US stock market. Below I will list several key conclusions based on my unique stock price development model and theory:

- Since 2000, and actually until now, the US market is forming a perfect trap-zone

- Technically, this trap-zone has been completed, just wait for the confirmation

- We are partly in the Bull's money-making zone, this Bull's money making zone will make a new higher high, if the upper boundary of the trap-zone is broken out successfully

- The dynamics of the trap-zone is the leading force for this range of the market motion

Beautiful yet powerful symmetry principle - GIGM as an example

- From ~2002 to ~2004, a trap-zone is formed

- Broken out of the trap-zone signals a reliable trend reversal

- Then GIGM goes up with ~ 2000% gain in several years, forming a symmetry round circle line

SVA - a typical stock price development chart

- accumulation stage: from 0.75 - 1.02

- push up stages

- the previous V bottom line is the life line for the bullish run

- 250 MA is another key

- The topping process is very interesting

Previous SVA charts, analysis, and snapshots are listed here.

Gap down - a sign of weakness

Gap down is an effective sign of weakness of bulls, especially closed down that day, if you apply it to the daily chart.

It is especially useful for a straight gap up move ( at least 3 gap ups in a row) in a almost 90 degree angle ! Once the gap down appears after a gap up, especially with a close down, then a measurable retreat is coming. A real example is ETFC, please refer to the following chart.

Other technical analysis tips can be found here as well.

A reply to the comments

"based on your theory, there are two dimensions, time and price move. Yes, you predicted the down-up-down move, but that is only one dimension. with different time dimensions, what you predicted can be right or wrong. What is more important, without knowing the time dimension, even though we know the price dimension will be down-up-down wave, we still don't know how to trade since we don't know when is the pivot point."

Here is my reply:

- All my analysis and predictions are free and just for sharing my market watch purpose. How to take advantage of it is your job.

- I have more than 5 trading and investment accounts to take care of, which is my first priority. So my market watch sharing may be not very quick. Please just read them for fun or try to learn how to follow the market trend, how to analyze the market. But don't follow my trading. Please read the "Disclaimer and Notice" at the end of the page, which is quoted below

Please keep in mind that any recommendations and revealed trades may be paper trading without real money involved. So trading stocks at your own decision since only you can control the RISK of your own trades."

- For the time dimension, I have some theory and rules to analyze them, for example, symmetry principle, magic number theory, etc. It's far more complex to explain in several sentences. It's extremely hard to understand and master also. I will share more on that when I feel it is ready to do so.

- With this sentence "with different time dimensions, what you predicted can be right or wrong." I think you are totally lost in my theory. You'd better read them again, especially read with the chart. The beauty of my stock price movement model is its distinct conclusion on the market movement. Otherwise, it is not applicable at all.

At least, the combination and correlation of the trap-zone and money-making zone has been clearly demonstrated.

The stock market just moves as predicted before

I quote some words from Last week's post below:

"Usually, this is not good for the bulls, especially when the Nasdaq market breaks down ~1990 again. "

"Currently, the market is in the stage of the UP, and I am expecting a DOWN wave to come once this UP wave is completed ! "

Now we are in the DOWN wave, as I expected after the DOWN and UP waves.

The first target of this DOWN wave is to hit the 50MA ....

A typical stock top pattern - STAR

- Divergence for the top

- V bottom line broken down

- Transition of the trap-zone

ETFC - measurable retreat

Once you see a V is forming, and smell that the V bottom line will be broken down, then take your profits first since such patterns will surely let you buy back at much lower prices.

The gap up is almost filled today. For more ETFC analysis and predictions, please follow the link here.

Important top and bottom chart signs

- double heads M pattern

- V pattern bottom line is broken down with new lower low

- divergence for the top

- Wait to sell at about or above the V pattern bottom line, when the price is in a UP wave

For the bottoms signs, make sure that the price can immediately climb up for a measurable amount after you buy.

- double or multiple bottom W pattern

- /\ (the reversal V) pattern top line is broken out with new high higher

- divergence for the bottom

- wait to buy at about or below the /\ pattern top line, when the price is in a DOWN wave

The KEY is to buy a stock when it is at the end of a DOWN wave, and to sell a stock when it is at the end of a UP wave.

SVA - 5 days chart

Previous SVA analysis, predictions, and other charts can be found here as well.

CLFD - Follow up 2 (up more than 9% today)

CLFD has been added to our 10 baggers' list for some time when it is around ~1.10.

To date, it is up almost 300%.

Isn't it wonderful !

Previous analysis can be found here.

SVA - the predicted target has been achieved

I also list below two previous calls on SVA.

Other breakout charts and stocks are available here.

What a nice day for ETFC so far

And, today, you see the power of the gap up already !

My systematic analysis of ETFC and other stocks with chart gallery can be found here.

Great day !

Stock Top Detectors -1 (ETFC as an example)

I have listed the following as stock top detectors:

- trap-zone

- 50 MA

- 250MA

- Down bar strength

- Up bar strength

- Down wave strength

- Up wave strength

Other technical analysis tips can be found here.