A reliable day trading signal – divergence between the EURO/USD and the U.S.A. stock market

This is a special report.

The uptrend continues this week, NASDAQ 1900 soon ?

The uptrend continues this week, will NASDAQ hit 1900 soon ?

The uptrend continues this week, will NASDAQ hit 1900 soon ?or before that, the market need a correction ? That's a question for us to think over the weekend. Isn't it fun ?

Here are some observations and informations from the charts.

From the weekly chart:

- a higher high is possible.

- so far the major correction happened when the upbound of the channel is touched

- The bulls support levels have not be broken down yet

- 1900 seems very possible in the near future

- 1770 is still the key support level for Bulls at this time

Additionally, Euro crashed a little, will this finally affect the US stock market ? absolutely. previous study is here, let's see this time.

The price movement tells if the stock is a good stock

in general, a long term bullish stock will climb ~ 1-5% a day, but consistently for 1-2 years, then some climax runs finally.

The volume should be relatively small.

More importantly, it is the price movement ! It should be 1 - 5 % all the time, no big movement but the moving up in price is very steady and consistent.

Nice day today

In a short time, you can complete the trade with nice profits. As predicted this morning, an intra-day reversal happened. It works very well.

In addition, as predicted at 10:00 AM (ET) this morning, the market (SP and NAZ) really closed down. Even though it is hard today.

Over the weekend, I will post some good signal analysis for day trading. One indicator is the currency market.

Oh. ye. Good day. Really it is. Enjoy !

One of our 10 baggers list today up 10% so far

This Monday I called it again. Please go to the link to read my comments on CLFD.

It is added to our 10 baggers list when it is about 1.20. Now already up ~ 0.35/1.20 = 29%.

The accumulation may be completed in the stock. Next stage may be the mark up stage.

Very nice.

It seems the list works just great.

Enjoy!

I hope you guys

The gap is also filled (completed) as predicted.

Nice profits, though.

A very possible intra-day reversal will happen today

Today's gap up will be filled.

These are my this morning's crazy predictions.

Jobless rate hits 9.4 in May of 2009, the highest in more than 25 years. The fundamental economy is still bad, actually very bad.

Euro has completed a dramatic change so far. Oil is about $70.

With regard to the global stock market, China dropped a little. Hong Kong and European stock market are up.

As mentioned before, watching the support levels of bulls very closely.

More fun today !

Three levels of support for bulls now

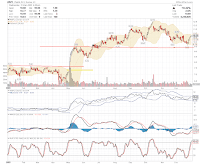

Three levels of support for bulls now, as shown on the NASDAQ daily chart.

Three levels of support for bulls now, as shown on the NASDAQ daily chart.I have no idea what's your feeling when you read the chart. But, I can tell you my felling: A climax run for the bulls is around the corner !

yes. it really is. Once RSI breaks out 70, I bet you will see a bull's home run. It should be very nice and powerful ! Enjoy !

I believe this bull's home run will kill many bears, especially for those full of short positions without any hedging or protection.

As mentioned last night, the Bulls and bears targets should be watched closely today. And the result of the battle is that Bulls easily reached their target. Therefore, bulls win.

To follow the trend, in my opinion, is to be a bull until all three bulls' supporting levels are broken. Especially, the NAZ 1770 level, as mentioned several times before.

However, please also notice the divergence marked in the chart. Divergence is just a warning sign for the bulls who are full of long positions. It doesn't mean the market will go down immediately. on the contrary, it usually means the market may go higher very quick, but then will pull back hard. The issue is you don't know when the pull back will come. So if you jump in as a bear when you see such divergences, you may get burned and wiped out before you see the market's actual pulling back as expected.

Tomorrow the unemployment rate

This is a key indicator for the economy.

It is worth watching how it changed over the time, and also how the market reacts over the numbers.

More fun tomorrow.

Bulls win so far today

Simple. Because the bulls achieved their targets very easily. I have mentioned these targets last night. For the chart marked with both bulls and bears targets, the link is here.

The bull's next target is here, as I mentioned several days ago in the market comments after the close.

In addition, as mentioned before, the bull's key support is NASDAQ 1770.

To follow the trend, to me, is to stick with the long positions as long as NASDAQ 1770 is not broken.

Oil is above 69 now ! PDS, one of our 10 bagger's list is up 7% so far, not bad at all.

JASO, one of our breakout watch list is also up 7% so far. Once 5.38 is broken out, it could has nice home run !!!!!

Euro has finished a trend reversal, now pretty a bullish set up. It is amazing ! I really can't believe it. But, never argue with the chart.

A lot of fluctuation should be seen today

Euro still in the down trend since yesterday.

Oil is about 68, and gold is about 970.

With regard to the global stock market, both China and Hong Kong stock market closed with a small down. European stock markets are mixed.

Today, the key bulls and bears target levels [2] should be closely watched since they are key for future directions.

Today's market close prediction has been updated [3].

[1] well trended

[2] Key targets

[3] Updated

more fighting are coming

on the way. Will bull win or bear win this time ?

Ok. It's too early to tell now.

In the chart, I have drawn the bear's target and bull's target.

so who first achieves its target, who will win the game.

That's the rule for this game. Let's watch the show. More fun!!

I also want to say, as a kind warning to bulls, that:

a diverence is shown up on the chart. more analysis will come later.

But it needs more confirmations and follow throughs...

GOOG ER play 2008 April charts

Three important time periods

1. the first half hour

2. the last half hour

3. Around lunch time

The market closed down today

However, the bouncing up at the end of the day is pretty impressive.

More analysis later.

The answer is gap up and run for two days

Develop some softwares

- can quickly scan the abnormal volume and price up pattern 15m before the market close.

- automatically show up charts of interested stocks quickly

- Charts that embedded in the web page, it's available now, but need much faster, and more flexible features.

A key trading skill

know the market's movement in a day just based on the first half hour's market activity observation.

It should be very useful ......

Did you ignore my warning this morning ??

I hope not. Here is the warning [1] again: a bloody day for bulls today. I got this conclusion just 5 minutes after the market open. That's my gut feeling. Usually very accurate.

QID will hit 34 very soon, where taking QID profits will never be blamed !

I still keep my this morning's market close prediction[2] !

What a nice day for me ! My longs (for example, ADLR[3] )up, and my shorts (for example, QID) up as well !

[1] bloody

[2] close

[3] ADLR

Our call yesterday is up in a bloody down day

Yesterday's call is here, ADLR is about 2.13 [1]. ~5% gain in less than a day, especially when the market is in a correction, not bad at all. Enjoy the ride up !

[1] ADLR 2.13

A bloody day for bulls

Our yesterday afternoon's gap down prediction is correct again, so far our Gap predictions just work amazingly well. Please check the link for our daily gap up/down predictions [1], hopefully it can help you with your trading activity.

Let's use QID as an example to show you how to use our tomorrow's Gap prediction [1] and today's market close predictions [2]. Yesterday afternoon, about half hour before market close, we predicted a gap down tomorrow, so buying QID at ~32. Then today we predict a down day, then QID may hit 34 very soon, either today or tomorrow. Then you can sell QID at 34 for a quick ~$2 profits per share in just ~ 2 days. That's basically how I use them for my own day-trading or very short term trend following trading activity.

Euro topped at 1.433 last night, and is heading south to find the support now, so far the down trend in Euro is pretty stable and well established. Oil is still ~ 67. With regard to the global stock market, ASIA and China have a nice up day, while European stock market is heading down.

The market is retesting the 1770 support [3] now after the gap up and run on Monday, as mentioned before.

[1] gaps

[2] close

[3] support

Ride the bear market's rally to the great depression ?

the bull market's rally, in my opinion. Don't you think so ? It's so energetic, you can feel your heart is beating with the market. Today, again an up day, after yesterday's gap up and run. So beautiful.

the bull market's rally, in my opinion. Don't you think so ? It's so energetic, you can feel your heart is beating with the market. Today, again an up day, after yesterday's gap up and run. So beautiful.However, the bull's show is not over yet. Be patient and watch more carefully. From the NASDAQ daily chart, I can tell

- The gap above, marked in the chart, is the bulls target

- Bulls really need to surge the volume to fill the gap

- 1770 is a key support of the bulls now [1]

A question that worth always asking yourself: Will we ride the bear market's rally to the great depression ? As Mr. Dent said below in his vedio show ? He has some amazing predictions before, let's watch and learn this time.

Economy watch by some famous guys

Therefore, I recommend the recent predictions by this guy, so that we can learn from his view, insight, and thinking.

His famous book last year is listed below:

The Great Depression Ahead: How to Prosper in the Crash Following the Greatest Boom in History

Enjoy !

What a nice day for Bulls !

I have already updated tomorrow's gap prediction [1]

Today's market close prediction [2] is correct, even though it is hard for today, 4 days in a row are correct so far. Not bad at all.

More analysis are coming tonight.

Nice consolidation this morning

Euro also hits 1.43, and makes a new high.

Yesterday, I think, very soon, I will announce that 1770 will become an important support level for bulls. Now it is more promising [2] .

ADLR attention

Is the climax run up coming ?

Euro has a correction last night, but then run up very nicely. It may hit 1.43 today. Other global markets enters the cosolidation now. Hang Seng down 2.64% yesterday. But Oil is still above 67. Amazing.

Our yesterday afternoon's gap down prediction is correct again, so far our Gap predictions just work amazingly well. Please check the link for our daily gap up/down predictions [1], hopefully it can help you with your trading activity.

Today, the bears and bulls will fight over yesterday's Gap. But I still think bulls are in control now. More updates after lunch.

Today's market close prediction has been updated as well.

[1] gaps

Turning off the comments feature in the blog is just great

It's just so great !!!!!

I find another way to spend my life wisely. oh ho ho ...................

Beak out with a gap !

Congratulations to the bulls.

Congratulations to the bulls.The NASDAQ chart finally break out the important resistance level 1773.13 with a gap, which I have mentioned several times before [1]. Do you think the gap happened here is just by chance or pure luck? Absolutely not ! The chart already reveals the story. If you still can't believe that, I suggest you to read these two books [2] before any trading. The small efforts will pay you off enormously. Yes, it will.

Please also notice that:

- the volume surged, very nice

- the macd formed a golden cross as well

I also think, very soon, I will anounce that 1770 will become an important support level for bulls.

Several days ago, I told our friend Ben it's impossible to see NASDAQ below 1700 before June 11. At that time, he didn't believe me. But now, trust me, he will totally agree with me.

So what we need to do now as an investor and trader ? My rule is simple, follow the trend, sit tightly with your long positions.

Then when should we sell our long positions and took the profits off the table ? Simple, look at the NASDAQ day chart, when the red support line I drew is broken down, it's time to take back our bets on the long side.

The pullback to test the support at 1770 may happen as soon as tomorrow, but don't lose your direction due to the winds from the market fluctuations.

CLFD looks so far so good [3].

[1] important resistance

[2] two books

[3] CLFD

How to tell a gap up will be the start of a bullish run ? RIMM as an example.

GM, Citi replaced by Cisco, Travelers in Dow-30

and

TRV

The change will be effective June 8, 2009. OK, no more GM and C in DOW-30. ho ho.

Gap up, and so far holds very well

Euro also looks good now. Today, bulls should be safe.

More are coming tonight.

GM bankrupted, Market Sizzled

Our gap up prediction last Friday is correct again, so far our Gap predictions just work amazingly well. Please check the link [1], hopefully it can help you with your trading activity.

For this mad bull's run up, it is not a surprise at all. It is predictable and very expectable [2]. Chart tells everything and the chart never lie to you. The key is we need to know how to read the Chart.

Oil hits 68 and Euro hits 1.42. Amazing.

But be careful, the Bears may fight back and the possible intra-day reversal since I noticed Euro is a little weak now.

If you sold EXEL above 6, then you have the opportunity to buy back at ~ 5. A very nice selling strategy, the chart illustration is here [4].

QID is heading to $30. So nice. I have warned to sell once 38 is broken. I did sell my QID at about 38. I can buy it back much cheaper later.

FAZ is heading to $2 as predicted before. I don't want to spend time to find my previous QID and FAZZ predictions posts. So if you want to learn more, you may go through the blog archives.

Our 10 bagger's list [5] so far performs very well. PDS is another 10% today. I want to call you guys to pay attention to CLFD, which may be a very good pick in the next 1-2 years because the company can benefit a lot from Obama's heavy economic simulation package.

For today's market close prediction, I have already updated[3].

Enjoy the ride up to all !

[1] Gaps prediction

[2] predictable run up

[3] Market close update

[4] Selling strategy

[5] 10 bagger's list

Abnormal behavior before the market close

What does this abnormal behavior before the market close mean ? Usually, it is a bullish sign, especially for stocks. Let's watch and learn.

[1] chart