A new IPO - AONE up 50% in the first day. It may induce some short term opportunities for either long or short side.

It is a battery maker.

Trade the stocks with a humble heart

I really think, as a human being, we need to trade the stocks with a humble heart, actually, a very humble heart. Because the stock market is very very complex for any one to precisely get in at the lowest point and get out at the highest price. That's impossible !

However, that doesn't mean nobody can make money from the stock market. Instead, some people really made a fortune from the stock market. One key factor for us to be able to make money from the stock market, I think, is to be humble !

Then how to be humble ?

Here is my answer: when the market is against you, you need to be humble, and then follow the market, not fight with it.

How to turn this answer into practice ? Take selling as an example:

However, that doesn't mean nobody can make money from the stock market. Instead, some people really made a fortune from the stock market. One key factor for us to be able to make money from the stock market, I think, is to be humble !

Then how to be humble ?

Here is my answer: when the market is against you, you need to be humble, and then follow the market, not fight with it.

How to turn this answer into practice ? Take selling as an example:

- You bought a stock ABCD at $10 and expect it go to $20 in one month. Unfortunately, it just climbs to $15 and coming back to $14, $13, and $12 ... what should you do then ? Still hold it and wait for your expected $20 to come in one day ? Absolutely not ! You need to be humble and protect your profits. Then you might wonder, what will happen if after my selling at $12, the stock jumps to $13. Take it easy, then. If you still think the stock ABCD can go back to $20 with a solid reason, then chase it ! No big deal ? right ?

- Holding positions always means you are exposed to some market risks. So stay alert ! Once the market development is against your expectation. Just sell all of them and protect yourself. Again, you can always buy back later when the market performs the way you expect.

As always, we

- buy in positions for expected profits; If the expected profits don't come as we expected, we need to exit the position to avoid the cash loss risk.

- sell out positions to avoid the expected loss; If the expected losses turned out to be a good profits opportunity, we need to be humble and buy back the position to avoid the missing opportunities.

However, to make these more practical, you need to build up a systematic approach and follow it closely by yourself.

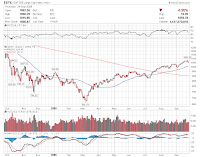

SPX analysis and expectations

ETFC updates and my expectations

As mentioned before, the gap up with negative divergence have induced a measurable correction on ETFC from above 2 to as low as 1.69 to date. Below are my expectations on ETFC:

- If it can not stands well above 1.80, it will test the 1.69 support

- Once 1.69 is broken down, I expect ETFC will come to 1.50 level again

- If 1.50 can not hold it, then 1.25 is the next retreat target

- The key is 250MA should level out and finally level UP

- I really don't expect it will come back to below 1.15 level, if so, which is very unexpected, then the big trend reversal as initially called here in ETFC is gone.

Expectations

Trading stocks is just like doing research ! You need to have expectations!

Following this way, your trading and investment skills will dramatically improve as time passes by.

- You have your hypotheses

- You have your expectations, which is based on your hypotheses

- The market development will either performs as you expected or not performs as you expected

Following this way, your trading and investment skills will dramatically improve as time passes by.

Warning sign for the Bulls

Warning sign for the Bulls: It has been for some time that I have not observed all stock indexes including China, Europe, and US are dropping largely at the end of the trading day. This could be a warning sign for the bulls - a market correction may be coming soon.

However, it still need to closely monitor the market in order to understand how deep and how long of this market correction . So, no panic yet for bulls.

It is still a bull market, the major trend has not changed. That's for sure. A trap-zone might be in the shaping now. That's the fact.

However, it still need to closely monitor the market in order to understand how deep and how long of this market correction . So, no panic yet for bulls.

It is still a bull market, the major trend has not changed. That's for sure. A trap-zone might be in the shaping now. That's the fact.

S&P 500 5 days chart update and comments

ETFC - 5 day charts update

This is an ETFC 5 days chart update.

- Previous "V" pattern bottom line broken down

- Gap up with negative divergence, signals a measurable correction

- Previous analysis on ETFC and other stocks can be found here.

FFBC - what kind of bullish run

FFBC - what kind of bullish run ! Really, it is ! The chart is pretty neat to study with!

Other important breakout charts are listed here as well.

Other important breakout charts are listed here as well.

ETFC - the money-making zone is in the shaping

ETFC - the money-making zone is in the shaping.

I will apply my stock price movement theory to chart the movement of ETFC from today. Previous analysis on ETFC and other stocks can be found here.

I will apply my stock price movement theory to chart the movement of ETFC from today. Previous analysis on ETFC and other stocks can be found here.

CLFD - continue to make new higher high

CLFD is so good today. It is making new higher high today. very nice !

Previous comments on CLFD can be found here.

Previous comments on CLFD can be found here.

Random Market Thoughts

Over the weekend, I have run over tons of historic chart to exam my trading system and hope to discover some truth and laws of trading and investment. Below is a brief list:

- In order to earn big, you need to be able to tolerate some market fluctuations. No bullish run is forming a line. So is the bearish move.

- The key is to identify the meaningful market corrections.

- These market corrections could lead to a trend reversal. You need to know when a market correction evolves into a trend reversal.

- Big trend changes slowly. If you want to earn big, you need to give your stocks and the market time to make your big profits.

- The key is to sit tight when you are correct. However, sitting tight doesn't mean doing nothing. You still need to closely watch the market development and understand its stages. You also need to know the signs for a meaningful market correction. More important, you need to know the signs for a market trend reversal.

- The rules could be simple. But it really requires a deep understanding the market, especially how the market motion is dynamically evolved.

ETFC chart updates

Below is the latest ETFC chart, there is a trap-zone, formed on the chart, so far.

ETFC initially grabbed my attention when its chart said a potential trend reversal. The initial chart and post can be found here.

Since then, some followups and comments on ETFC can be found here.

ETFC initially grabbed my attention when its chart said a potential trend reversal. The initial chart and post can be found here.

Since then, some followups and comments on ETFC can be found here.

Subscribe to:

Comments (Atom)